Leading Entertainment Titans Influencing the Global Industry

In today’s fast-changing media and entertainment arena, a select group of major corporations hold substantial sway over how content is created, distributed, and experienced worldwide. These conglomerates operate across diverse platforms such as cinema, television, streaming services, music, and gaming, allowing them to influence cultural trends and generate significant revenue. For example, Disney capitalizes on an extensive portfolio of intellectual properties, integrating theme parks and merchandise to craft immersive brand experiences that foster customer loyalty and drive sustained expansion. Similarly, Comcast’s NBCUniversal merges traditional broadcast networks with innovative streaming offerings, exemplifying a strategic balance between legacy media and digital transformation.

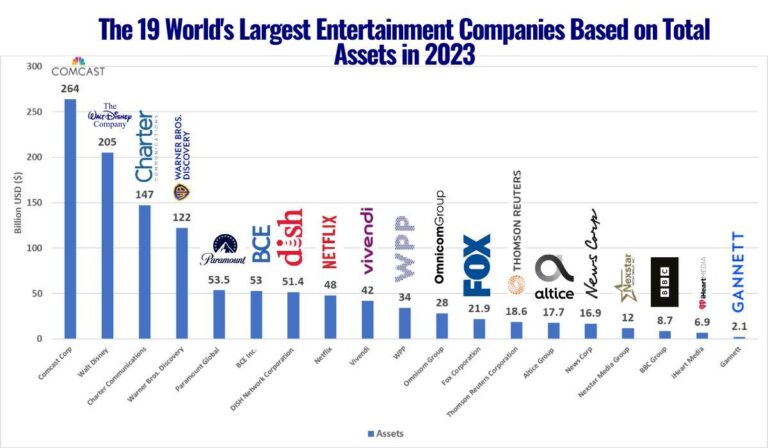

Below is a comparative overview of some of the top players, showcasing their annual revenues, international presence, and content production capabilities. Their ongoing adaptability—embracing new technologies and evolving consumer preferences—ensures they maintain a competitive edge in an increasingly fragmented entertainment landscape.

| Company | Annual Revenue | Global Footprint | Content Portfolio |

|---|---|---|---|

| Disney | $82B+ | Operates in 100+ countries | Blockbuster movies, TV shows, exclusive streaming content |

| Comcast (NBCUniversal) | $55B+ | Available in 90+ countries | News, sports, scripted and reality programming |

| Netflix | $45B+ | Accessible in 190 countries | Original films, international series, documentaries |

| Warner Bros. Discovery | $40B+ | Presence in 150+ countries | Franchise films, cable channels, streaming platforms |

- Cross-Platform Integration: These conglomerates boost earnings by combining marketing efforts and bundling content across various media.

- Intellectual Property Investments: Acquiring and expanding content libraries and franchises to fuel future productions.

- Global Market Customization: Developing region-specific content to attract diverse audiences and advertisers worldwide.

Financial Indicators That Inspire Investor Trust

Investors closely monitor several key financial indicators that demonstrate the resilience and growth potential of leading entertainment firms. Sustained revenue increases signal their ability to capture expanding market segments amid industry shifts. Profitability metrics, including operating and net margins, reveal how effectively companies control expenses relative to income. Additionally, trends in earnings per share (EPS) provide insights into profitability and prospects for dividends or reinvestment.

Financial stability is further assessed through liquidity and solvency ratios, which indicate a company’s capacity to endure economic fluctuations. Ratios such as current assets to liabilities and debt-to-equity highlight fiscal health and leverage strategies. Free cash flow (FCF) remains a vital measure of operational strength, reflecting funds available for innovation, acquisitions, or shareholder returns—key factors underpinning investor confidence. The table below summarizes these metrics for representative entertainment companies:

| Company | Revenue Growth | Operating Margin | EPS Growth | Debt-to-Equity Ratio | Free Cash Flow |

|---|---|---|---|---|---|

| Company X | 13% | 19% | 16% | 0.42 | $3.2B |

| Company Y | 10% | 21% | 11% | 0.58 | $2.7B |

| Company Z | 15% | 22% | 19% | 0.35 | $4.0B |

Growth Strategies and Expansion Tactics in Entertainment

Top entertainment firms are aggressively pursuing growth through a combination of organic innovation and strategic acquisitions. Their initiatives focus on broadening digital content offerings, entering emerging markets, and investing in advanced technologies such as virtual reality (VR) and artificial intelligence (AI) for content creation. Collaborations across industries also help diversify revenue and deepen audience engagement across multiple platforms.

Recent examples of these strategies include:

- Localized Content Development: Tailoring programming to meet the preferences of rapidly growing markets in Asia and Latin America.

- Technological Innovation: Incorporating augmented reality (AR) into traditional entertainment formats to enhance viewer immersion.

- Content Acquisition: Expanding proprietary intellectual property by acquiring niche studios and digital networks.

| Company | Strategic Focus | Recent Development |

|---|---|---|

| Entertainment Leader 1 | Streaming Growth | Introduced region-specific streaming platforms in India |

| Media Powerhouse 2 | VR Content Creation | Partnered with tech startups to develop immersive experiences |

| Studio Collective 3 | IP Expansion | Acquired a renowned independent animation studio |

Expert Insights on Managing Industry Uncertainty

Given the volatile nature of the media sector, industry experts emphasize the importance of agility and diversification to mitigate risks. Expanding content across various platforms and genres reduces reliance on any single revenue source. Embracing emerging technologies like AI-driven content generation and advanced data analytics enhances personalization and audience targeting. Building strategic alliances within the entertainment ecosystem also enables companies to pool resources and better respond to shifting consumer demands.

Robust risk management practices, including comprehensive scenario planning, are essential for navigating potential disruptions such as regulatory changes or supply chain challenges. The following table outlines key approaches adopted by leading firms to maintain resilience:

| Approach | Advantage |

|---|---|

| Diversification | Reduces exposure by balancing content portfolios |

| Technology Integration | Improves content delivery and customization |

| Strategic Collaborations | Expands market reach and resource sharing |

| Scenario Planning | Prepares for economic and regulatory uncertainties |

Final Thoughts

As the entertainment industry continues to transform through technological advancements and evolving audience preferences, these top ten companies remain pivotal in steering the future of global media consumption. Investors aiming to capitalize on this dynamic sector should closely observe the strategic initiatives and financial performance of these leaders. Staying abreast of their developments provides valuable insights into emerging trends and lucrative opportunities within the entertainment market.