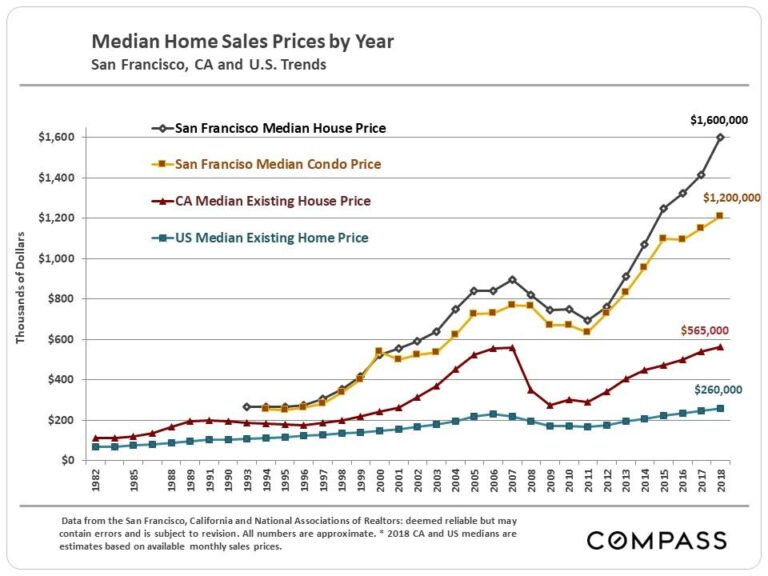

As the dynamics of housing supply continue to evolve, the real estate markets of San Francisco and San Jose are drawing close attention for their shifting home prices. In this analysis, The Business Journals examines how these two pivotal Bay Area cities compare to national trends, uncovering the factors influencing local pricing and what they signal for buyers and sellers alike.

San Francisco and San Jose Home Prices Face Pressure Amid Changing Supply

In recent months, the dynamic housing markets of San Francisco and San Jose have felt the impact of a shifting supply landscape. Inventory levels, once tightly constrained, have begun to expand as new developments enter the market and homeowners respond to changing economic conditions. This adjustment is exerting downward pressure on home prices, diverging from the rapid growth seen over the past several years. Experts highlight that while demand remains steady, the increased availability of properties is prompting more competitive pricing strategies among sellers.

Key factors influencing the price movements include:

- Rising construction completions adding fresh inventory

- Changing migration patterns affecting buyer interest

- Adjustment in mortgage rates influencing affordability

- Policy shifts encouraging housing supply improvements

| City | Median Home Price (USD) | Monthly Supply Change (%) |

|---|---|---|

| San Francisco | $1,350,000 | +5.2% |

| San Jose | $1,200,000 | +6.8% |

| National Average | $430,000 | +3.4% |

How National Market Trends Are Influencing Bay Area Real Estate Values

National market dynamics are reshaping the real estate landscape of the Bay Area as shifts in supply reverberate through local home values. Rising mortgage rates, changing demand patterns, and increased construction in other metropolitan markets have created a ripple effect, influencing both San Francisco and San Jose property prices. Sellers in these tech-driven hubs are adapting, with many reevaluating pricing strategies to stay competitive amid a more balanced market.

Several core factors are driving this transformation:

- Increased inventory nationwide is easing upward price pressure, giving buyers more options beyond the Bay Area.

- Competitive up-and-coming markets such as Austin and Denver are attracting new residents and investment, redirecting some demand away from California.

- Local tech sector resilience continues to support foundational home values, though with moderated growth compared to prior years.

| Region | Year-over-Year Price Growth | Median Home Price |

|---|---|---|

| San Francisco | +3.2% | $1.4M |

| San Jose | +2.7% | $1.3M |

| National Average | +1.5% | $400K |

Although prices in the Bay Area remain well above the national average, the relative pace of appreciation reflects the broader recalibration occurring across the housing market. As the national supply conditions continue to evolve, Bay Area real estate values will likely maintain their premium while adjusting to the new market equilibrium shaped by these larger trends.

Experts Break Down What Buyers and Sellers Can Expect Moving Forward

Market experts emphasize that the shifting supply dynamics in San Francisco and San Jose are set to create a more balanced landscape for both buyers and sellers. With inventory levels beginning to stabilize after a period of scarcity, buyers can expect a modest increase in options, leading to less aggressive bidding wars but still a competitive environment. Sellers, on the other hand, may need to adjust expectations, as the days of rapid price surges could give way to steadier, sustainable growth that aligns more closely with national trends.

Key factors influencing this adjustment include:

- Economic recovery: Job growth in the tech sector remains strong, supporting demand.

- Interest rate fluctuations: Rate hikes may taper buyer enthusiasm but also cool overheating markets.

- Policy changes: Local measures targeting affordable housing could moderate price acceleration.

| Region | Median Home Price (2024) | Year-over-Year Change | Inventory Status |

|---|---|---|---|

| San Francisco | $1.4M | +2.8% | Balanced |

| San Jose | $1.3M | +3.1% | Growing |

| National Average | $395K | +5.0% | Tight |

Overall, the forecast points toward a market where smart buyers can find opportunities, but must remain vigilant about inflationary pressures and regional economic performance. Sellers will benefit by pricing properties realistically and considering timing carefully as national factors exert increasing influence over the traditionally high-flying Bay Area real estate market.

Strategic Tips for Navigating the Shifting Housing Landscape in Silicon Valley

In today’s competitive market, understanding the dynamics affecting Silicon Valley real estate is essential for both buyers and sellers. With supply tightening in key areas like San Francisco and San Jose, strategic approaches can make all the difference. Prospective buyers should prioritize flexibility, considering neighborhoods slightly outside traditional tech hubs where emerging infrastructure and amenities are driving growth. For sellers, timing the market correctly by leveraging seasonal demand surges can maximize offers in an environment with increasingly capped inventory.

- Buyers: Broaden your search radius, be ready to act quickly, and secure pre-approvals early.

- Sellers: Invest in home staging and highlight energy-efficient upgrades to stand out.

- Both parties: Collaborate with agents who have hyper-local insights and data-driven strategies.

| City | Median Home Price | Year-over-Year Change | National Rank |

|---|---|---|---|

| San Francisco | $1.4M | +5.2% | 3 |

| San Jose | $1.2M | +4.8% | 5 |

| National Average | $425K | +7.1% | N/A |

To Wrap It Up

As supply dynamics continue to evolve, the contrasting trajectories of home prices in San Francisco and San Jose offer a telling snapshot of broader national trends. While both markets reflect the pressures of limited inventory and shifting demand, their differing responses underscore the complexity facing buyers and sellers alike. Monitoring these changes will be crucial for stakeholders seeking to navigate the ever-changing landscape of the U.S. housing market in the months ahead.