Exploring the Decline in Home Prices Across Select U.S. Cities: Causes and Insights

Key Drivers Behind the Recent Drop in Housing Prices

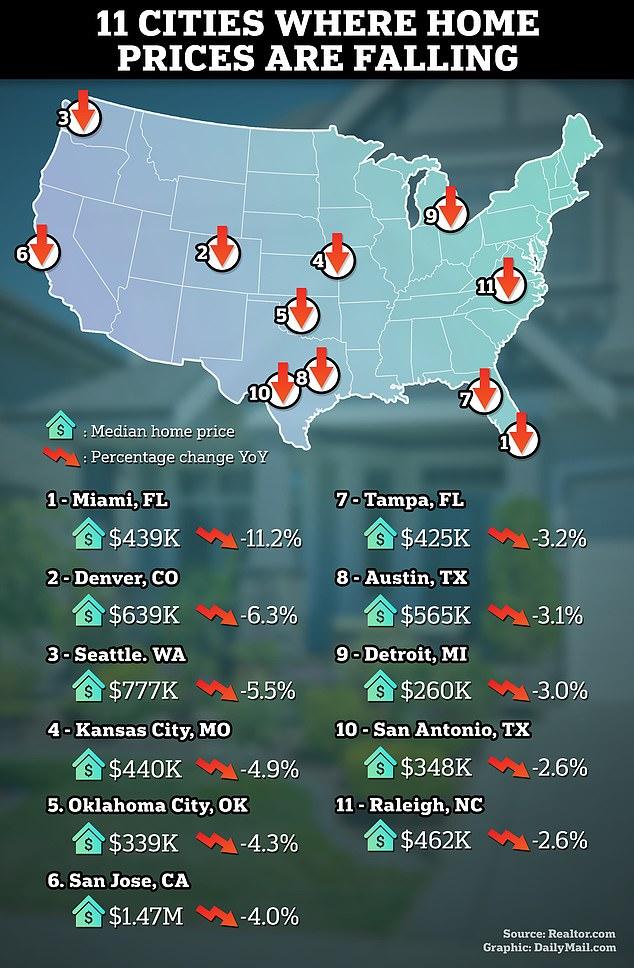

Across various metropolitan areas in the United States, residential property values are experiencing significant downturns. This shift is largely influenced by a combination of economic pressures and evolving buyer behaviors. One of the foremost contributors is the surge in mortgage interest rates, which has substantially diminished purchasing power for many potential homeowners. Following a series of Federal Reserve rate hikes, monthly mortgage obligations have escalated, prompting many buyers to reconsider or downsize their housing choices. This phenomenon is especially evident in cities that witnessed rapid price escalations over the past decade, now undergoing a market correction as affordability becomes increasingly strained.

Additionally, changing migration trends have played a pivotal role. Cities that previously attracted residents due to the rise of remote work are now seeing some population outflows as workers return to office environments or seek more cost-effective living arrangements elsewhere. This demographic shift, coupled with an oversupply of homes in certain markets, has intensified competition among sellers, leading to longer listing durations and price reductions.

- Excess housing inventory from recent overdevelopment

- Reduced buyer enthusiasm amid inflationary challenges

- Economic unpredictability deterring high-value investments

- Transformation in work habits influencing residential preferences

| Influencing Factor | Effect on Market |

|---|---|

| Elevated Mortgage Rates | Decreased affordability for buyers |

| Housing Surplus | Increased seller competition and price concessions |

| Population Movement | Demand shifts toward more affordable regions |

| Inflation and Economic Challenges | Heightened living expenses and cautious purchasing |

Economic Conditions and Their Role in Housing Affordability Variations

The economic health of different U.S. regions significantly impacts housing market trends and affordability. Areas experiencing job contractions, particularly those reliant on manufacturing or resource extraction industries, often see a corresponding dip in housing demand and prices. For example, cities in the Midwest with economies tied to automotive manufacturing and coal mining have recently faced economic slowdowns, resulting in more accessible housing prices but increased financial uncertainty for residents.

Conversely, metropolitan regions with diverse economic bases and steady employment growth tend to sustain or even appreciate home values despite broader economic headwinds. However, within these areas, affordability can vary widely depending on factors such as wage increases, migration inflows, and consumer confidence levels.

| City | Change in Unemployment Rate | Year-over-Year Job Growth | Percentage Decline in Median Home Price |

|---|---|---|---|

| Detroit, MI | +1.5% | -2.3% | 12.4% |

| Buffalo, NY | +0.8% | -1.0% | 10.1% |

| St. Louis, MO | +1.0% | -0.7% | 9.8% |

| Cleveland, OH | +1.2% | -1.5% | 11.0% |

- Higher unemployment rates generally lead to reduced housing demand.

- Negative job growth accelerates market price adjustments.

- Regional economic shifts shape long-term housing affordability trends.

Effective Approaches for Homebuyers Amid Declining Prices

For prospective buyers, the current market downturn offers unique opportunities to secure properties at more favorable prices. Conducting detailed research on local neighborhoods experiencing the steepest price drops can uncover undervalued areas with promising future appreciation. Early mortgage pre-approval is advisable to enhance bargaining power when desirable homes become available. Patience during negotiations is essential, as sellers may be more inclined to accept offers amid increased inventory and reduced buyer competition.

Buyers should also broaden their search criteria, considering homes that require cosmetic renovations rather than major structural repairs, which can provide cost savings and personalization potential. Prioritizing properties located in reputable school districts or near upcoming infrastructure developments can further enhance long-term value.

- Utilize inspection contingencies to negotiate repairs or price adjustments.

- Investigate available government assistance programs tailored for buyers during market slowdowns.

- Evaluate short-term financing options to reduce initial expenses amid price fluctuations.

Guidance for Homeowners in Markets Experiencing Price Reductions

Homeowners facing depreciating property values should focus on maintaining financial flexibility and planning for the long term. Preserving a healthy emergency fund is vital to avoid forced sales during adverse market conditions. Refinancing existing mortgages to secure lower interest rates or more adaptable payment plans can alleviate monthly financial pressures. Staying updated on local market trends and economic indicators enables informed decisions regarding the timing of sales or home improvements.

Incremental home enhancements that improve appeal without significant investment—such as fresh paint, landscaping, or minor kitchen and bathroom updates—can increase marketability. Engaging with local real estate professionals for regular property valuations and monitoring community developments can provide valuable insights into future market directions.

- Maintain detailed records of all home repairs and upgrades.

- Consult with real estate experts for ongoing market assessments.

- Consider rental options if selling is not currently advantageous.

| Recommended Strategy | Advantage |

|---|---|

| Mortgage Refinancing | Reduced monthly payments |

| Emergency Savings | Prevents urgent sales |

| Minor Home Improvements | Enhances property appeal |

| Professional Market Consultations | Anticipate market changes |

Final Thoughts: Navigating the Changing U.S. Housing Market

As the U.S. housing market continues to evolve amid economic shifts, it is crucial for buyers, sellers, and investors to stay informed about regional trends and underlying factors influencing property values. While falling home prices present challenges for sellers, they simultaneously open doors for increased affordability and investment opportunities. A comprehensive understanding of market drivers, combined with strategic planning, will empower stakeholders to make sound real estate decisions in this dynamic environment.