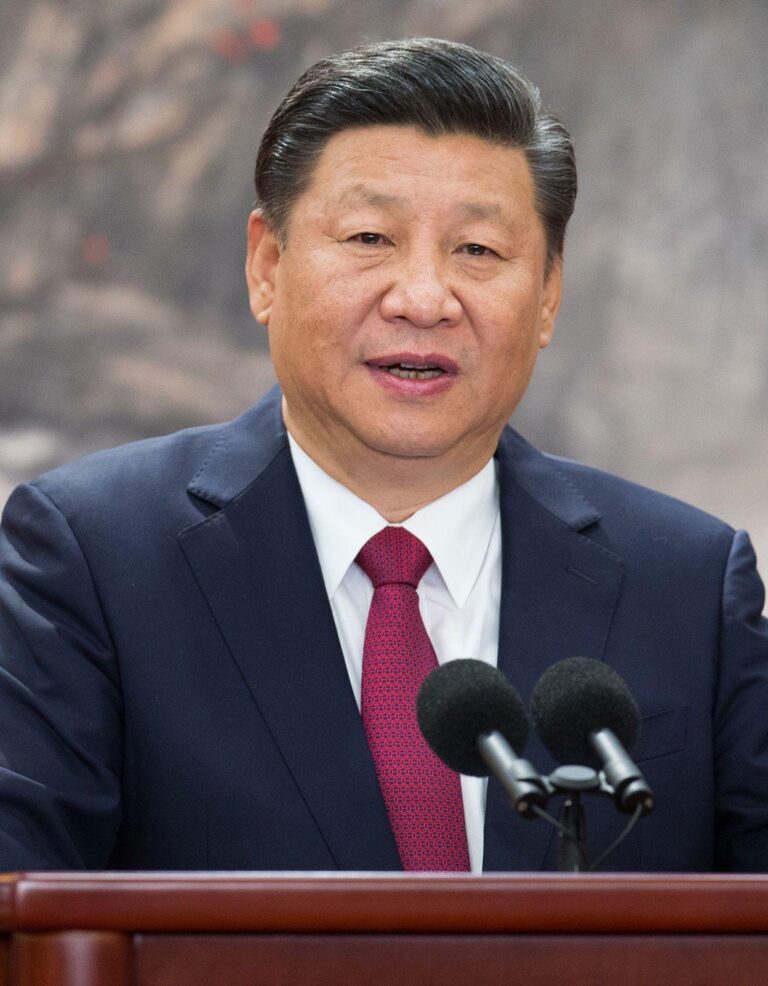

US Corporations Approach Xi Jinping’s Economic Invitation with Caution Amid Rising Tensions

American Businesses’ Wariness Toward China’s Economic Appeal

In a recent speech targeting American enterprises, Chinese President Xi Jinping encouraged deeper economic collaboration, highlighting the expanding opportunities within China’s dynamic market. Despite this, many leading US companies remain hesitant, citing persistent regulatory ambiguities, intellectual property vulnerabilities, and the volatile geopolitical environment as significant deterrents. Rather than viewing Beijing’s invitation as a sincere effort to foster cooperation, numerous executives interpret it as a strategic maneuver lacking concrete reforms to ensure fair treatment and market stability for foreign investors.

Primary concerns voiced by US firms include:

- Uneven application and enforcement of foreign business regulations

- Heightened oversight and potential penalties linked to stringent technology export controls

- Lack of transparency in governmental decision-making impacting market entry and partnerships

- Ongoing US-China trade disputes and tariff uncertainties

| Industry | Sentiment Level | Likely Consequences |

|---|---|---|

| Technology | Strong skepticism | Reduced joint innovation efforts |

| Manufacturing | Cautious optimism | Delayed capacity expansion |

| Financial Services | Mixed perspectives | Selective engagement in Chinese markets |

Economic and Political Challenges Amplify US Corporate Distrust

Despite President Xi’s efforts to revive enthusiasm for China among US businesses, the backdrop of intensifying economic and political frictions fuels ongoing apprehension. Concerns over unpredictable regulatory shifts, inadequate protection of intellectual property, and the ripple effects of geopolitical disputes continue to overshadow promises of open markets and mutual benefit. Business leaders acknowledge that succeeding in China demands not only commercial savvy but also a strategic evaluation of political risks that could disrupt operations and profitability.

Factors exacerbating US firms’ skepticism include:

- Increased regulatory vigilance: More rigorous enforcement of data privacy and antitrust regulations.

- Heightened geopolitical strain: Escalating US-China tensions influencing trade and investment policies.

- Ambiguous legal environment: Unclear contract enforcement and dispute resolution processes.

| Risk Element | Severity | Corporate Strategy |

|---|---|---|

| Regulatory Volatility | High | Supply chain diversification |

| Political Disputes | Moderate | Enhanced geopolitical risk monitoring |

| Intellectual Property Risks | High | Robust legal protections and contracts |

Recommended Strategies for US Companies Operating in China’s Complex Environment

Given the evolving geopolitical landscape and regulatory unpredictability, US enterprises must implement a comprehensive strategy that balances engagement with prudent risk management. Key approaches include:

- Supply chain diversification: Minimizing dependence on Chinese manufacturing by expanding operations in regions such as Southeast Asia, India, or Latin America.

- Strengthening compliance systems: Aligning with both US and Chinese legal requirements to avoid sanctions and trade restrictions.

- Forging reliable local partnerships: Collaborating with reputable Chinese firms to better navigate regulatory and bureaucratic challenges.

Investing in intelligence gathering and scenario planning is also critical to anticipate and mitigate potential disruptions. The following risk assessment framework can assist companies in evaluating their exposure:

| Risk Category | Potential Consequence | Suggested Mitigation |

|---|---|---|

| Regulatory Clampdowns | Severe operational disruptions | Expand legal teams and local compliance resources |

| US-China Tariff Policies | Moderate cost increases | Relocate sourcing to tariff-exempt countries |

| Restrictions on Technology Transfers | High R&D limitations | Invest in proprietary innovation outside China |

Weighing Risks and Rewards: A Delicate Balance for US Investors in China

US investors find themselves navigating a complex landscape where the promise of China’s vast consumer market and technological progress is tempered by geopolitical tensions and regulatory unpredictability. Although President Xi Jinping’s recent appeals seek to attract American capital, many investors remain cautious, mindful of the challenges posed by intellectual property concerns, market access restrictions, and inconsistent policy enforcement.

Critical factors for investors to consider include:

- Regulatory clarity: Adapting to shifting rules that can abruptly affect business operations.

- Political volatility: Managing risks stemming from diplomatic conflicts impacting trade and investment flows.

- Market entry limitations: Understanding constraints on foreign participation in key sectors.

- Long-term viability: Assessing whether short-term profits justify sustained exposure to uncertainty.

| Aspect | Opportunity | Risk |

|---|---|---|

| Consumer Market | Over 1.4 billion potential customers | Complex regulatory hurdles |

| Technological Advancement | Rapid expansion in AI, 5G, and green tech | Persistent intellectual property challenges |

| Policy Landscape | Recent reforms aimed at easing foreign investment | Opaque enforcement and inconsistent application |

Final Thoughts

As President Xi Jinping reaches out to American businesses amid strained Sino-US relations, the cautious reception from US corporations highlights deep-rooted mistrust and geopolitical complexities. While Beijing’s push for enhanced economic engagement seeks to narrow the divide, the prevailing skepticism among industry leaders suggests that restoring confidence will be a gradual and challenging endeavor. The trajectory of this relationship will remain a pivotal indicator for the future of the world’s largest bilateral economic partnership.