Understanding Middle-Class Income Across AmericaŌĆÖs Major Cities: A Contemporary Perspective

Reevaluating Middle-Class Income in Urban America

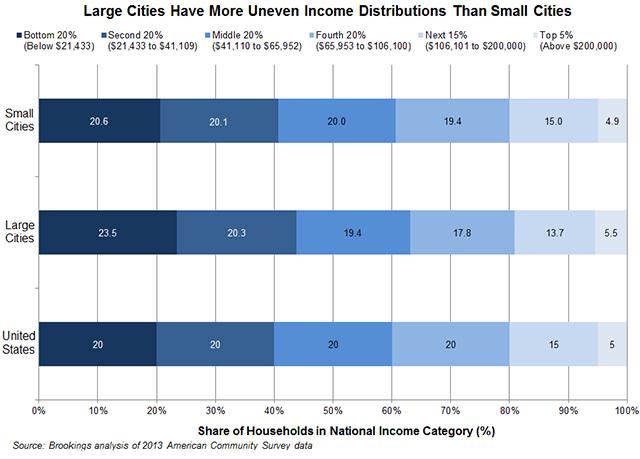

The definition of middle-class income in the United States is far from uniform, especially when viewed through the lens of its largest metropolitan areas. Traditionally, middle-class earnings are pegged between roughly 67% and 200% of a cityŌĆÖs median household income. However, this range fluctuates widely depending on local economic conditions, housing affordability, and cost of living. For example, in high-cost cities like San Francisco and New York, the income required to sustain a middle-class lifestyle can be nearly twice the national median, driven by exorbitant housing prices and living expenses. In contrast, cities such as Houston and Phoenix offer a more affordable environment where similar income levels afford greater financial comfort and discretionary spending.

Rather than a fixed number, middle-class income should be viewed as a flexible range shaped by the ability to:

- Meet essential living expenses including rent or mortgage, utilities, and food without financial strain

- Secure access to quality education and healthcare for household members

- Build savings and prepare for retirement, emergencies, and future investments

- Enjoy moderate leisure and cultural activities that contribute to overall well-being

| City | Median Household Income (2024) | Estimated Middle-Class Income Range |

|---|---|---|

| New York, NY | $72,000 | $48,000 – $144,000 |

| Chicago, IL | $60,000 | $40,000 – $120,000 |

| Houston, TX | $55,000 | $37,000 – $110,000 |

| San Francisco, CA | $120,000 | $80,000 – $240,000 |

How Rising Living Costs Reshape Middle-Class Realities

Escalating expenses in major metropolitan areas have intensified financial pressures on middle-income households, forcing many to adjust their spending habits and lifestyle expectations. Key cost drivers such as housing, healthcare, and transportation have surged faster than wage increases, eroding purchasing power. In cities like San Francisco and New York, median rents now consume upwards of 40% of household income, a figure that far exceeds the traditional affordability benchmark of 30%, signaling a shift in what it means to live comfortably as middle class.

Several critical factors contribute to this affordability challenge:

- Escalating housing prices: Limited housing supply combined with high demand inflates rental and purchase costs beyond national norms.

- Increasing healthcare costs: Rising insurance premiums and medical expenses add significant financial burdens.

- Transportation expenses: Longer commutes and fluctuating fuel prices increase daily costs.

- General inflation: The cost of groceries, utilities, and other essentials continues to climb.

| City | Median Rent (% of Income) | Healthcare Cost Index | Average Commute Time (minutes) |

|---|---|---|---|

| San Francisco | 43% | 130 | 36 |

| Chicago | 33% | 112 | 32 |

| Dallas | 29% | 108 | 28 |

| New York | 40% | 118 | 41 |

Income Benchmarks and Economic Mobility: A City-Level Analysis

The income range that defines the middle class varies widely across metropolitan areas, shaped by local economic conditions, housing markets, and employment opportunities. For instance, maintaining a middle-class lifestyle in San Francisco may require an annual income between $85,000 and $170,000, whereas in Houston, the comparable range is closer to $50,000 to $100,000. These differences highlight how local factors influence financial security and quality of life.

Economic mobilityŌĆöthe capacity for individuals to improve their financial standingŌĆöalso differs significantly among cities. Urban centers with diverse economies and strong educational systems, such as Seattle and New York, tend to offer greater upward mobility. Conversely, cities with limited job diversity and entrenched inequality often see stagnant or declining mobility, making it harder for middle-class families to advance.

| City | Lower Income Threshold | Upper Income Threshold | Economic Mobility Ranking* |

|---|---|---|---|

| New York | $62,000 | $124,000 | 11 |

| Los Angeles | $57,000 | $114,000 | 17 |

| Chicago | $47,000 | $94,000 | 23 |

| Atlanta | $44,000 | $88,000 | 29 |

| Seattle | $67,000 | $134,000 | 9 |

| * Rankings based on recent studies evaluating economic mobility across U.S. cities | |||

Key drivers of economic mobility include:

- Diverse employment sectors: A broad job market enhances resilience against economic downturns.

- Access to quality education: Proximity to universities and training centers fosters skill development.

- Affordable housing options: Helps prevent income erosion due to excessive living costs.

- Community investment: Long-term funding in infrastructure and social programs supports sustainable growth.

Approaches to Strengthening Middle-Class Stability in High-Cost Cities

Preserving middle-class financial security in cities with steep living expenses requires multifaceted strategies. One effective method involves implementing local policies that promote affordable housing. This can include revising zoning laws to encourage the development of middle-income housing, offering incentives to builders, and instituting rent control measures to curb displacement. Additionally, expanding and improving public transit systems can reduce commuting costs and broaden housing options for working families.

Building economic resilience also depends on workforce development initiatives that align with growing industries such as technology, healthcare, and renewable energy. Providing accessible upskilling and retraining programs enables workers to transition into higher-paying roles. Supporting entrepreneurship through grants and simplified regulations further diversifies local economies, creating more job opportunities and fostering financial stability for middle-class households.

Conclusion: Recognizing the Nuances of Middle-Class Income Across U.S. Cities

Defining middle-class income in AmericaŌĆÖs largest urban centers requires acknowledging the complex interplay of local economic factors, housing markets, and living costs. This analysis reveals that middle-class status is not a fixed income bracket but a fluid range shaped by each cityŌĆÖs unique financial landscape. For policymakers, businesses, and residents, understanding these distinctions is vital to crafting solutions that address economic disparities and promote sustainable growth within urban communities.