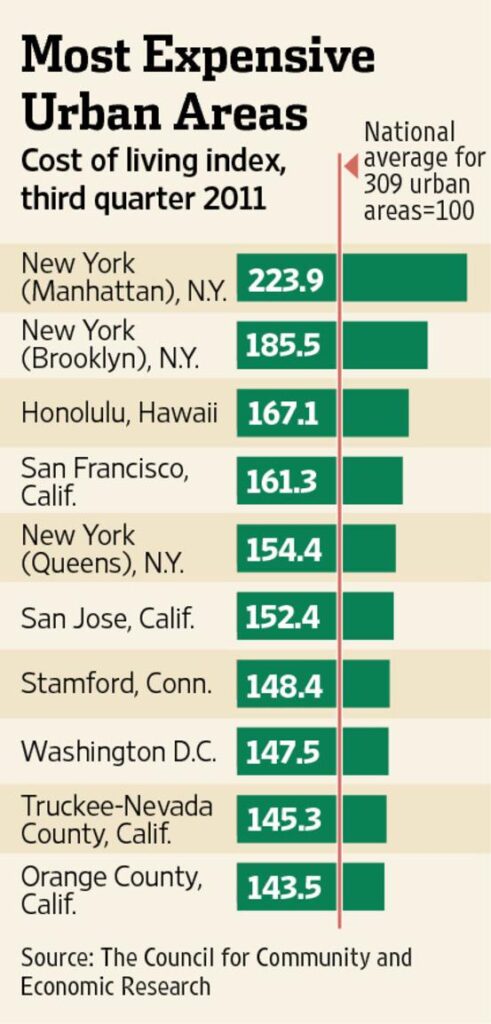

Unveiling the Financial Realities of Living in San Francisco

San Francisco is renowned worldwide for its dynamic innovation scene, rich cultural tapestry, and breathtaking vistas. Yet, beneath the city‚Äôs celebrated image lies a complex financial landscape that often deters potential residents. A recent Business Insider analysis, titled ‚Äú13 Facts About San Francisco That Will Make You Think Twice About Whether You Can Afford to Live There,‚ÄĚ exposes the economic and lifestyle hurdles that define life in this iconic city. From exorbitant housing prices to concealed living costs, these insights reveal why many find San Francisco financially daunting‚ÄĒand what implications this holds for the city‚Äôs trajectory.

Financial Strain on Household Budgets: The Cost of Living in San Francisco

The escalating cost of daily necessities in San Francisco continues to place significant strain on family finances. Essential expenses such as groceries and utilities have surged, compelling residents to carefully allocate their limited resources. Housing costs remain the most overwhelming burden, with rent often consuming nearly half of a household‚Äôs monthly earnings. This financial pressure frequently forces compromises in other vital areas like healthcare and education. Additionally, transportation expenses‚ÄĒwhether through public transit fares or vehicle upkeep‚ÄĒfurther tighten budgets, prompting many to reconsider their commuting options or residential choices.

To illustrate the financial demands, here is an updated overview of average monthly expenditures for a typical middle-income household in San Francisco:

| Category | Average Monthly Cost (USD) | Percentage of Income |

|---|---|---|

| Rent (1-Bedroom Apartment) | $3,450 | 47% |

| Groceries | $670 | 9% |

| Utilities | $230 | 3% |

| Transportation | $320 | 4% |

| Healthcare | $420 | 6% |

This breakdown highlights how nearly half of a typical income is absorbed by rent alone, leaving limited room for other essential expenses. Consequently, many residents resort to downsizing their living spaces, trimming discretionary spending, or seeking additional income streams to stay afloat.

Barriers to Homeownership: Navigating San Francisco’s Housing Market

The San Francisco housing market remains one of the most challenging in the nation for buyers. With median home prices frequently exceeding $1.35 million, affordability is a significant obstacle for first-time buyers and middle-class families. The situation is exacerbated by restrictive zoning regulations and protracted approval processes that limit new housing developments, thereby constraining the availability of affordable homes. Intense competition often leads to bidding wars, with properties selling well above their listed prices, making homeownership an elusive goal for many.

Meanwhile, the rental market reflects similar pressures, with high demand driving up monthly rents and forcing many to reconsider their long-term residency plans. Below is a comparative snapshot of current housing costs:

| Housing Type | Average Monthly Rent | Median Home Price |

|---|---|---|

| Studio Apartment | $2,600 | N/A |

| 1-Bedroom Apartment | $3,300 | N/A |

| Single-Family Home | N/A | $1,350,000 |

- Competitive bidding wars: Properties often sell 15-25% above asking price.

- Scarcity of affordable listings: Limited supply keeps prices elevated.

- Extended commutes: Many buyers look to suburbs and outlying areas for affordability.

Transportation Costs and Commute Patterns: Influencing Daily Life Choices

Transportation expenses in San Francisco significantly affect residents’ monthly budgets. A monthly Muni pass now costs approximately $88, while gasoline prices consistently remain above the national average, often exceeding $4.50 per gallon. For those relying on rideshare services like Uber or Lyft, costs can escalate rapidly, especially for late-night workers or those living in transit-poor neighborhoods.

San Francisco’s average one-way commute time stands at around 33 minutes, ranking among the longest in the United States. This reality influences decisions about where to live and work, with many opting for more affordable housing farther from the city center. However, longer commutes can increase stress and reduce time available for family and leisure, presenting a difficult trade-off for many residents.

- Average monthly public transit expense: $88

- Typical one-way commute duration: 33 minutes

- National ranking for peak traffic congestion: Top 10

| Mode of Transport | Average Monthly Cost | Average Commute Time (minutes) |

|---|---|---|

| Muni (Bus & Metro) | $88 | 42 |

| Private Vehicle (Fuel + Parking) | $270+ | 31 |

| Rideshare (Uber/Lyft) | $220+ | Varies |

Strategies for Managing San Francisco’s Financial Demands

Successfully navigating San Francisco’s high cost of living requires strategic financial planning and resourcefulness. While rent and daily expenses remain steep, many residents mitigate these challenges by adopting practical approaches such as:

- Co-living arrangements: Sharing housing with roommates significantly reduces rent burdens.

- Utilizing public transportation: The extensive Muni and BART systems often eliminate the need for car ownership.

- Capitalizing on employer benefits: Numerous tech firms provide commuting subsidies and housing allowances to ease financial pressures.

Additionally, understanding San Francisco’s tax environment and labor market dynamics is vital for maintaining financial health. Accounting for California’s relatively high state income taxes and negotiating salaries with cost-of-living adjustments can make a meaningful difference. Awareness of neighborhood affordability also helps balance proximity to employment centers with manageable living costs.

| Neighborhood | Median Monthly Rent | Distance to Major Employment Hubs |

|---|---|---|

| SOMA | $3,750 | Less than 1 mile |

| Outer Sunset | $2,550 | Over 5 miles |

| Mission District | $3,400 | Within 2 miles |

Conclusion: The Ongoing Affordability Challenge in San Francisco

As San Francisco continues to face escalating living costs and economic pressures, these revealing facts provide a crucial understanding of what it truly means to reside in the city. For those considering relocation or investment, grasping the financial realities behind the city’s famed skyline is indispensable. Whether these insights alter your perception of the City by the Bay or confirm existing concerns, one truth remains: affordability is a pivotal issue that will shape San Francisco’s future for years ahead.